Page 65 - Profiles's Unit Trusts & Collective Investments - September 2024

P. 65

Costs and Pricing

Reduction in Yield

RiY is a method used by the life assurance industry to illustrate the possible effect of costs on

an investment. It is expressed as a percentage designed to estimate the decrease in total annual

returns likely to be attributable to costs.

The total annual return is the percentage gain per year as a result of capital appreciation,

interest and dividends (assuming these are reinvested). An RiY of 3% means that the product

provider expects that 3% of the annual return – over the life of the product – will be absorbed by

costs. This figure can be deceptive: it reflects actual percentage points, not a fraction.

For example, assuming total growth of 10% per annum, an RiY of 3% means a net return of 7%

per annum (not 93% of 10%, which would be a net return of 9.3% per annum). To put it

differently, if a fund suffered zero growth, a so-called 3% RiY would mean a 3% per annum

reduction in capital, which equates to 14% total loss over five years (ignoring income).

RiY, as a future estimate rather than an historical calculation, is fraught with problems and can

be misleading. Firstly, the projected annual return, which is an unknown, impacts the RiY

inversely (ie, RiY rises with returns where annual fees are a percentage of investment value). So

conservative projections actually understate RiY. Secondly, because it includes upfront costs (like

commissions), it is sensitive to the time period – the RiY on a product held for 10 years will be

lower than the RiY over five years, all other things being equal. Hence assurers can play down RiY

by using long time-period projections. Thirdly, RiY does not take into account penalties that may

be levied if contractual contributions are reduced or stopped (and, historically, a minority of

policies go the distance). These and other factors mean that RiY is a highly inexact method of

estimating costs to the investor.

Retirement Savings Cost Disclosure (RSC)

The RSC, effective from March 2019, is designed to assist potential and existing employers

and/or boards of trustees (referred to as “clients” in the ASISA standard) when comparing

retirement fund quotations.

The RSC differs from the EAC because the latter is aimed at individuals. The RSC is aimed at

employers and trustees, it is not a member level cost disclosure standard and is not designed for

individual fund members.

For products that combine life cover and investment plans, the RSC applies to the savings

element only.

The RSC Disclosure Standard does not apply to RA funds (including group RA funds),

preservation funds, beneficiary funds, compulsory annuities and other retail products provided

that they are disclosing the EAC.

The template must show four separate components into which defined charges are allocated

over four investment periods:

Investment management charges

Advice charges

Administration charges

Other charges including regulatory, compliance and governance costs

The RSC is calculated separately for each of the four components and then totalled to derive the

RSC for the umbrella fund as a whole. The value for each of the components, as well as the total

RSC, is expressed as a percentage of the investment amount.

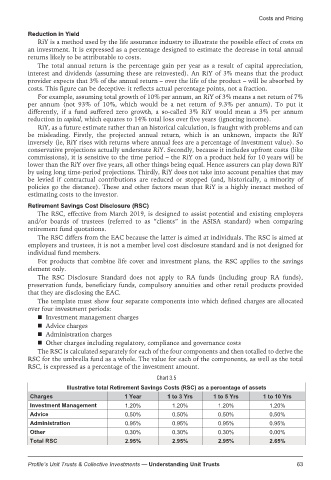

Chart 3.5

Illustrative total Retirement Savings Costs (RSC) as a percentage of assets

Charges 1 Year 1 to 3 Yrs 1 to 5 Yrs 1 to 10 Yrs

Investment Management 1.20% 1.20% 1.20% 1.20%

Advice 0.50% 0.50% 0.50% 0.50%

Administration 0.95% 0.95% 0.95% 0.95%

Other 0.30% 0.30% 0.30% 0.00%

Total RSC 2.95% 2.95% 2.95% 2.65%

Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts 63