Page 328 - Profile's Unit Trusts & Collective Investments - September 2025

P. 328

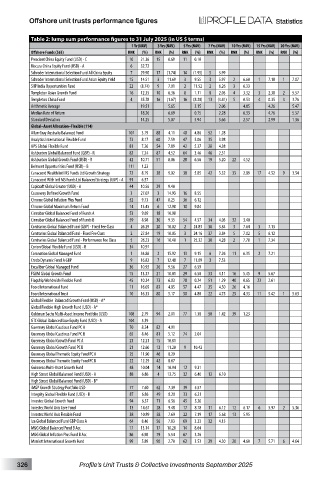

Offshore unit trusts performance figures

Table 2: lump sum performance figures to 31 July 2025 (in US $ terms)

1 Yr (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 15 Yrs (NAV) 20 Yrs (NAV)

Offshore Funds (563) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Prescient China Equity Fund (USD) - C 10 21.36 15 0.69 11 0.10

Riscura China Equity Fund (USD) - A 6 32.72

Schroder International Selection Fund All China Equity 7 29.90 17 (1.74) 14 (1.95) 5 3.99

Schroder International Selection Fund Asian Equity Yield 15 14.51 3 11.69 3 9.55 3 5.97 2 6.60 1 7.18 1 7.07

SIIP India Opportunities Fund 22 (8.74) 9 7.01 2 11.52 2 6.26 3 6.33

Templeton Asian Growth Fund 16 12.35 10 6.36 8 1.11 8 2.03 4 3.32 3 2.38 2 5.57

Templeton China Fund 4 35.78 16 (1.67) 16 (8.20) 13 (3.41) 5 0.53 4 0.35 3 3.76

Arithmetic Average 19.51 5.65 3.15 2.06 4.85 4.26 5.47

Median Rate of Return 18.26 6.69 0.75 2.28 6.33 4.76 5.57

Standard Deviation 14.25 5.07 5.94 3.66 2.57 2.99 1.36

Global–Asset Allocation–Flexible (114)

Allan Gray Australia Balanced Fund 107 3.19 88 4.11 48 4.86 52 1.28

Analytics International Flexible Fund 73 8.17 60 7.59 47 5.06 35 3.98

APS Global Flexible Fund 81 7.26 54 7.89 42 5.37 28 4.38

Ashburton Global Balanced Fund (GBP) - R 82 7.24 87 4.52 64 3.46 46 2.51

Ashburton Global Growth Fund (USD) - R 42 10.71 51 8.06 28 6.56 19 5.20 22 4.52

Belmont Opportunities Fund (USD) - B 111 1.23

Canaccord Wealth Intl MS Funds Ltd Growth Strategy 72 8.19 38 9.02 38 5.85 42 3.32 33 2.89 17 4.52 9 3.54

Canaccord Wlth Intl MS Funds Ltd Balanced Strategy (GBP) - A 91 6.57

Capicraft Global Creator (USD) - A 44 10.56 29 9.40

Causeway Defined Growth Fund 3 27.07 3 14.93 16 8.55

Chrome Global Inflation Plus Fund 52 9.73 47 8.25 36 6.12

Chrome Global Maximum Return Fund 14 13.45 6 12.98 10 9.84

Cinnabar Global Balanced Fund of Funds A 53 9.69 18 10.08

Cinnabar Global Balanced Fund of Funds B 59 8.98 30 9.35 54 4.57 34 4.03 32 3.40

Contrarius Global Balanced Fund (GBP) - Fixed Fee Class 4 26.29 20 10.02 2 24.83 38 3.84 3 7.64 3 7.13

Contrarius Global Balanced Fund - Fixed Fee Class 2 27.84 19 10.05 3 24.16 37 3.84 5 7.02 5 6.12

Contrarius Global Balanced Fund - Performance Fee Class 5 26.23 16 10.40 1 25.32 30 4.28 2 7.78 1 7.34

Corion Global Flexible Fund (USD) - B 34 10.97

Coronation Global Managed Fund 1 34.86 2 15.92 13 9.15 6 7.26 11 6.35 2 7.21

Credo Dynamic Fund A GBP 9 16.82 7 12.48 7 11.09 3 7.53

Excalibur Global Managed Fund 36 10.92 26 9.56 27 6.59

FGAM Global Growth Fund 15 13.37 21 10.01 29 6.50 33 4.11 16 5.45 9 5.67

Flagship Worldwide Flexible Fund 45 10.34 73 6.03 78 0.24 51 1.29 40 0.65 23 2.61

Foord International Fund 11 16.05 83 4.85 57 4.47 25 4.50 26 4.16

Foord International Trust 10 16.33 80 5.17 50 4.80 22 4.75 25 4.33 11 5.42 1 5.63

Global Flexible Balanced Growth Fund (USD) - A*

Global Flexible High Growth Fund (USD) - A*

Goldman Sachs Multi-Asset Income Portfolio (USD) 108 2.79 94 2.01 77 1.38 50 1.42 39 1.23

GTC Global Balanced Low Equity Fund (USD) - A 104 5.39

Guernsey Global Cautious Fund PC A 70 8.24 82 4.91

Guernsey Global Cautious Fund PC B 65 8.46 81 5.12 74 2.04

Guernsey Global Growth Fund PC A 23 12.21 15 10.81

Guernsey Global Growth Fund PC B 21 12.60 12 11.20 9 10.42

Guernsey Global Thematic Equity Fund PC A 25 11.90 46 8.29

Guernsey Global Thematic Equity Fund PC B 22 12.29 42 8.67

Guinness Multi-Asset Growth Fund 48 10.04 14 10.94 12 9.31

High Street Global Balanced Fund (USD) - A 88 6.86 4 13.75 32 6.40 12 6.10

High Street Global Balanced Fund (USD) - B*

iMGP Growth Strategy Portfolio USD 77 7.60 62 7.39 39 5.57

Integrity Global Flexible Fund (USD) - B 87 6.86 49 8.20 33 6.21

Investec Global Growth Fund 94 6.37 71 6.56 45 5.20

Investec World Axis Core Fund 13 14.67 28 9.48 17 8.18 11 6.12 12 6.17 6 5.97 2 5.36

Investec World Axis Flexible Fund 38 10.89 58 7.69 22 7.19 17 5.68 13 5.95

Iza Global Balanced Fund GBP Class A 64 8.46 56 7.83 69 3.23 32 4.15

M&G Global Balanced Fund B Acc 17 13.14 17 10.28 14 8.64

M&G Global Inflation Plus Fund B Acc 86 6.98 79 5.54 67 3.26

Marriott International Growth Fund 99 5.89 90 2.70 62 3.53 29 4.30 20 4.60 7 5.71 6 4.64

326 Profile’s Unit Trusts & Collective Investments September 2025