Page 247 - Profile's Unit Trusts & Collective Investments - September 2025

P. 247

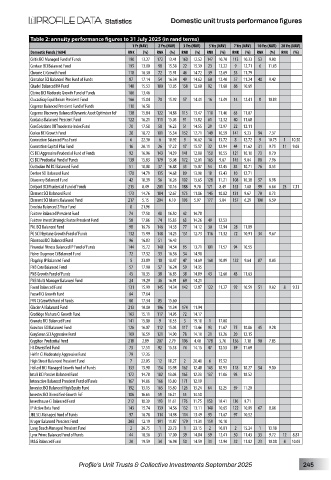

Domestic unit trusts performance figures

Table 2: annuity performance figures to 31 July 2025 (in rand terms)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1604) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Celtis BCI Managed Fund of Funds 190 13.27 172 13.41 160 12.52 147 10.70 113 10.33 53 9.00

Centaur BCI Balanced Fund 195 13.00 98 15.38 22 15.39 23 13.22 9 12.71 6 11.03

Chrome Ci Growth Fund 118 16.30 72 15.91 46 14.72 39 12.69 33 11.79

Cinnabar SCI Balanced Plus Fund of Funds 87 17.14 54 16.34 49 14.62 60 12.40 57 11.24 40 9.42

Citadel Balanced H4 Fund 148 15.53 180 13.05 158 12.60 92 11.68 86 10.69

Citrine BCI Moderate Growth Fund of Funds 186 13.46

ClucasGray Equilibrium Prescient Fund 166 15.04 70 15.92 57 14.41 16 13.49 14 12.41 8 10.83

Cogence Balanced Prescient Fund of Funds 110 16.58

Cogence Discovery Balanced Dynamic Asset Optimiser FoF 138 15.84 122 14.88 115 13.47 110 11.46 63 11.07

Cordatus Balanced Prescient Fund 122 16.21 111 15.03 91 13.82 61 12.32 40 11.68

CoreSolutions OUTmoderate Index Fund 70 17.58 58 16.23 51 14.55 29 12.97 22 12.11

Corion BCI Growth Fund 28 18.72 101 15.34 152 12.71 149 10.59 141 9.23 94 7.37

Coronation Balanced Plus Fund 6 22.30 6 18.92 9 16.62 14 13.72 8 12.72 9 10.75 1 10.50

Coronation Capital Plus Fund 16 20.11 26 17.22 17 15.57 32 12.94 44 11.62 31 9.75 11 9.03

CS BCI Aggressive Prudential Fund of Funds 92 16.96 143 14.39 141 12.88 150 10.55 121 10.10 73 8.70

CS BCI Prudential Fund of Funds 139 15.83 179 13.08 172 12.01 165 9.67 145 9.04 88 7.96

Custodian IM BCI Balanced Fund 51 18.08 37 16.88 33 15.07 54 12.45 84 10.71 76 8.53

Denker SCI Balanced Fund 170 14.79 135 14.68 89 13.90 18 13.43 10 12.71

Discovery Balanced Fund 42 18.39 56 16.26 102 13.65 128 11.21 108 10.38 57 8.98

Dotport BCI Prudential Fund of Funds 215 8.49 201 10.16 188 9.78 171 8.49 153 7.68 99 6.64 23 7.31

Element SCI Balanced Fund 173 14.76 184 12.67 175 11.86 145 10.82 131 9.67 70 8.73

Element SCI Islamic Balanced Fund 217 5.15 204 6.10 193 5.97 177 5.84 157 6.29 100 6.59

Excelsia Balanced 27four Fund 8 21.96

Fairtree Balanced Prescient Fund 74 17.50 48 16.50 42 14.78

Fairtree Invest Strategic Factor Prescient Fund 58 17.86 74 15.85 63 14.26 49 12.53

FAL BCI Balanced Fund 98 16.76 146 14.33 77 14.12 30 12.94 28 11.89

FG SCI Neptune Growth Fund of Funds 132 15.99 148 14.25 151 12.73 116 11.32 72 10.91 34 9.67

Fibonacci BCI Balanced Fund 96 16.83 51 16.43

Financial Fitness Balanced IP Fund of Funds 144 15.72 140 14.54 95 13.71 101 11.57 94 10.55

Fisher Dugmore Ci Balanced Fund 72 17.52 53 16.36 34 14.98

Flagship IP Balanced Fund 5 23.89 10 18.47 47 14.69 160 10.09 132 9.64 87 8.05

FNB Core Balanced Fund 57 17.90 57 16.24 59 14.35

FNB Growth Fund of Funds 45 18.35 38 16.85 38 14.89 43 12.60 43 11.63

FNB Multi Manager Balanced Fund 24 19.29 36 16.91 69 14.21

Foord Balanced Fund 131 15.99 145 14.34 142 12.87 122 11.27 92 10.59 51 9.02 8 9.33

Fussell Ci Growth Fund 64 17.64

FVV Ci Growth Fund of Funds 80 17.34 85 15.60

Glacier AI Balanced Fund 213 10.00 196 11.34 174 11.94

Gradidge Mahura Ci Growth Fund 163 15.11 117 14.95 72 14.17

Granate BCI Balanced Fund 141 15.80 9 18.55 3 19.18 1 17.00

Graviton SCI Balanced Fund 126 16.07 112 15.03 117 13.46 93 11.67 75 10.86 45 9.28

GraySwan SCI Aggressive Fund 109 16.59 121 14.90 78 14.10 21 13.26 20 12.15

Gryphon Prudential Fund 218 2.89 207 2.79 196 4.40 178 5.76 156 7.18 90 7.85

H4 Diversified Fund 73 17.51 92 15.53 74 14.15 47 12.53 39 11.69

Helfin Ci Moderately Aggressive Fund 79 17.35

High Street Balanced Prescient Fund 7 22.05 12 18.27 2 20.40 6 15.52

Hollard BCI Managed Growth Fund of Funds 133 15.98 154 13.98 162 12.48 143 10.93 118 10.27 54 9.00

Imali BCI Passive Balanced Fund 172 14.78 182 13.03 165 12.33 137 11.06 98 10.52

Interactive Balanced Prescient Fund of Funds 167 14.86 166 13.80 171 12.19

Investec BCI Balanced High Equity Fund 192 13.15 165 13.80 126 13.24 64 12.25 59 11.20

Investec BCI Diversified Growth FoF 106 16.65 59 16.21 55 14.50

Investhouse Ci Balanced Fund 212 10.39 193 11.61 176 11.75 153 10.41 130 9.71

IP Active Beta Fund 143 15.74 139 14.56 132 13.11 148 10.65 122 10.09 67 8.86

JBL SCI Managed Fund of Funds 97 16.78 114 14.98 114 13.49 95 11.67 97 10.52

Kruger Balanced Prescient Fund 203 12.19 191 11.87 179 11.31 159 10.10

Long Beach Managed Prescient Fund 2 26.75 1 23.73 1 23.15 2 16.81 2 15.24 1 13.18

Lynx Prime Balanced Fund of Funds 44 18.36 31 17.00 39 14.84 59 12.41 50 11.43 33 9.72 12 8.81

M&G Balanced Fund 20 19.59 34 16.94 50 14.59 31 12.94 32 11.82 23 10.08 4 10.03

Profile’s Unit Trusts & Collective Investments September 2025 245