Page 237 - Profile's Unit Trusts & Collective Investments - September 2025

P. 237

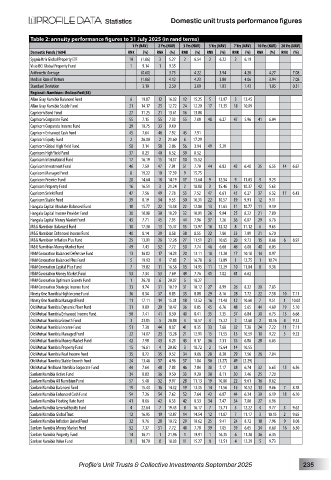

Domestic unit trusts performance figures

Table 2: annuity performance figures to 31 July 2025 (in rand terms)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1604) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Sygnia Itrix Global Property ETF 10 (1.06) 3 5.27 2 6.54 2 6.22 2 6.19

Visio BCI Global Property Fund 1 9.14 1 9.35

Arithmetic Average (0.60) 3.73 4.22 3.94 4.28 4.27 7.08

Median Rate of Return (1.06) 4.12 4.23 3.80 4.06 3.94 7.08

Standard Deviation 3.19 2.50 2.09 1.83 1.43 1.05 0.31

Regional–Namibian–Unclassified (58)

Allan Gray Namibia Balanced Fund 6 19.87 12 16.02 12 15.25 5 13.97 3 12.45

Allan Gray Namibia Stable Fund 21 14.17 25 12.72 24 12.20 17 11.35 18 10.09

Capricorn Bond Fund 27 11.25 21 13.61 16 13.88

Capricorn Corporate Fund 55 7.15 55 7.33 55 7.08 48 6.27 47 5.96 41 6.04

Capricorn Corporate Income Fund 29 10.75 33 9.60

Capricorn Enhanced Cash Fund 45 7.64 46 7.92 45 7.91

Capricorn Equity Fund 2 26.00 2 21.60 6 17.29

Capricorn Global High Yield Fund 58 3.14 58 2.86 56 3.94 49 5.29

Capricorn High Yield Fund 37 8.23 40 8.52 39 8.52

Capricorn International Fund 17 16.19 15 14.37 10 15.52

Capricorn Investment Fund 46 7.59 47 7.91 51 7.70 44 6.83 42 6.48 35 6.55 14 6.67

Capricorn Managed Fund 8 19.22 10 17.39 9 15.75

Capricorn Premier Fund 20 14.64 18 14.19 17 13.64 9 12.54 9 11.05 9 9.25

Capricorn Property Fund 16 16.51 3 21.24 2 18.88 3 15.46 16 10.37 42 5.63

Capricorn Selekt Fund 47 7.56 49 7.78 53 7.52 47 6.61 45 6.27 37 6.32 17 6.43

Capricorn Stable Fund 39 8.19 34 9.55 30 10.31 22 10.57 19 9.91 12 9.11

Hangala Capital Absolute Balanced Fund 18 15.77 22 13.38 22 12.80 13 11.63 11 10.77 11 9.19

Hangala Capital Income Provider Fund 30 10.08 30 10.29 32 10.01 26 9.04 25 8.22 21 7.80

Hangala Capital Money Market Fund 43 7.71 45 7.95 44 7.96 37 7.26 36 6.87 29 6.76

M&G Namibian Balanced Fund 10 17.38 13 15.47 15 13.97 10 12.32 8 11.12 6 9.65

M&G Namibian Enhanced Income Fund 40 8.14 39 8.58 38 8.55 32 7.80 33 7.09 31 6.70

M&G Namibian Inflation Plus Fund 25 13.01 26 12.26 27 11.51 21 10.65 20 9.73 15 8.66 6 8.97

M&G Namibian Money Market Fund 49 7.43 52 7.72 50 7.74 46 6.68 46 6.08 40 6.05

NAM Coronation Balanced Defensive Fund 13 16.82 17 14.23 20 13.11 18 11.20 17 10.18 14 8.97

NAM Coronation Balanced Plus Fund 5 19.93 9 17.83 7 16.78 6 13.89 1 12.75 1 10.74

NAM Coronation Capital Plus Fund 7 19.82 11 16.58 13 14.95 11 12.29 10 11.04 8 9.36

NAM Coronation Money Market Fund 53 7.34 53 7.69 49 7.76 41 7.02 41 6.62

NAM Coronation Optimum Growth Fund 1 26.78 6 20.07 5 18.27

NAM Coronation Strategic Income Fund 33 9.74 31 10.19 31 10.12 27 8.99 26 8.22 20 7.83

Ninety One Namibia High Income Fund 36 8.54 37 8.85 35 8.88 29 8.16 28 7.72 22 7.58 10 7.11

Ninety One Namibia Managed Fund 11 17.11 14 15.01 18 13.52 16 11.48 12 10.60 7 9.51 1 10.02

Old Mutual Namibia Dynamic Floor Fund 31 9.89 29 10.47 36 8.85 45 6.76 48 5.65 44 4.69 19 5.10

Old Mutual Namibia Enhanced Income Fund 50 7.41 41 8.50 40 8.41 35 7.35 37 6.84 30 6.75 13 6.68

Old Mutual Namibia Growth Fund 3 23.85 5 20.84 4 18.57 4 15.22 2 12.68 2 10.16 4 9.32

Old Mutual Namibia Income Fund 51 7.38 44 8.07 41 8.35 33 7.68 32 7.28 24 7.22 11 7.11

Old Mutual Namibia Managed Fund 22 14.07 23 13.28 21 12.91 15 11.55 13 10.59 10 9.22 5 9.23

Old Mutual Namibia Money Market Fund 42 7.98 43 8.23 43 8.17 36 7.31 35 6.88 28 6.85

Old Mutual Namibia Property Fund 15 16.61 4 20.92 3 18.72 2 15.64 14 10.55

Old Mutual Namibia Real Income Fund 35 8.72 35 9.52 34 9.06 28 8.30 29 7.56 26 7.04

Old Mutual Namibia Stable Growth Fund 24 13.46 57 4.96 57 1.84 50 (1.27) 49 (2.29)

Old Mutual Nedbank Namibia Corporate Fund 44 7.64 48 7.83 46 7.84 38 7.17 38 6.74 32 6.65 15 6.56

Sanlam Namibia Active Fund 34 8.83 36 9.50 33 9.20 30 8.11 30 7.46 25 7.20

Sanlam Namibia All Namibian Fund 57 5.48 32 9.97 28 11.13 19 10.80 22 9.61 16 8.62

Sanlam Namibia Balanced Fund 19 15.43 16 14.32 19 13.35 14 11.56 15 10.52 13 9.06 7 8.78

Sanlam Namibia Enhanced Cash Fund 54 7.26 54 7.62 52 7.64 42 6.87 44 6.34 39 6.19 18 6.10

Sanlam Namibia Floating Rate Fund 41 8.06 42 8.33 42 8.33 34 7.47 34 7.00 27 6.96

Sanlam Namibia General Equity Fund 4 22.64 7 19.45 8 16.17 7 13.71 5 12.22 4 9.77 3 9.62

Sanlam Namibia Global Trust 12 16.95 19 13.87 14 14.54 12 11.87 7 11.17 3 10.15 2 9.65

Sanlam Namibia Inflation Linked Fund 32 9.76 28 10.72 29 10.62 25 9.41 24 8.72 18 7.96 9 8.08

Sanlam Namibia Money Market Fund 52 7.37 51 7.72 48 7.78 39 7.05 39 6.65 34 6.60 16 6.50

Sanlam Namibia Property Fund 14 16.71 1 21.96 1 19.91 1 16.35 6 11.28 36 6.35

Sanlam Namibia Value Fund 9 18.70 8 18.03 11 15.27 8 13.51 4 12.29 5 9.73

Profile’s Unit Trusts & Collective Investments September 2025 235