Page 207 - Profile's Unit Trusts & Collective Investments - September 2025

P. 207

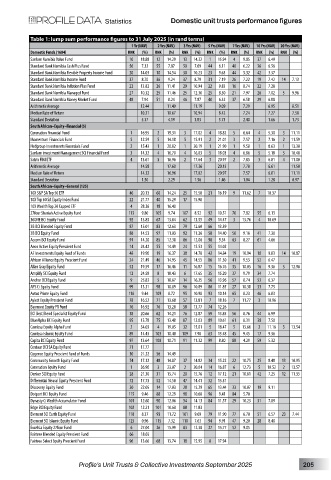

Statistics Domestic unit trusts performance figures

Table 1: lump sum performance figures to 31 July 2025 (in rand terms)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1604) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Sanlam Namibia Value Fund 10 18.88 12 14.29 13 14.32 1 15.94 4 9.85 37 6.49

Standard Bank Namibia Cash Plus Fund 56 7.32 55 7.87 50 7.69 44 6.11 40 6.22 36 6.56

Standard Bank Namibia Flexible Property Income Fund 20 14.03 10 14.54 30 10.23 23 9.63 44 5.32 42 3.37

Standard Bank Namibia Income Fund 37 8.70 36 9.24 37 8.79 31 7.19 26 7.22 19 7.42 14 7.13

Standard Bank Namibia Inflation Plus Fund 22 13.82 26 11.41 29 10.94 22 9.83 16 8.74 22 7.28

Standard Bank Namibia Managed Fund 27 10.32 25 11.46 25 12.30 25 8.50 21 7.97 26 7.02 5 9.96

Standard Bank Namibia Money Market Fund 48 7.94 51 8.24 46 7.87 40 6.32 37 6.58 29 6.88

Arithmetic Average 12.44 11.49 11.19 9.09 7.29 6.95 8.51

Median Rate of Return 10.21 10.67 10.94 8.42 7.24 7.27 7.58

Standard Deviation 5.37 4.19 3.83 3.73 2.40 1.66 1.73

South African–Equity–Financial (5)

Coronation Financial Fund 1 16.95 2 19.31 3 17.02 4 18.82 5 6.64 4 5.30 3 11.11

Momentum Financials Fund 5 12.59 5 14.18 5 15.91 2 21.01 3 7.57 2 7.16 2 11.59

Nedgroup Investments Financials Fund 2 15.43 1 20.82 1 20.19 1 21.90 1 9.58 1 8.63 1 13.30

Sanlam Investment Management SCI Financial Fund 3 14.32 4 16.70 4 16.03 5 18.03 4 6.86 5 5.18 5 10.48

Satrix FINI ETF 4 13.61 3 16.96 2 17.64 3 20.97 2 7.85 3 6.81 4 11.00

Arithmetic Average 14.58 17.60 17.36 20.15 7.70 6.61 11.50

Median Rate of Return 14.32 16.96 17.02 20.97 7.57 6.81 11.11

Standard Deviation 1.50 2.29 1.56 1.46 1.04 1.28 0.97

South African–Equity–General (125)

10X S&P SA Top 50 ETF 46 20.13 60 14.24 25 15.50 21 16.19 9 11.62 7 10.37

10X Top 60 SA Equity Index Fund 22 21.77 40 15.29 17 15.98

10X Wealth Top 20 Capped ETF 4 28.36 18 16.40

27four Shariah Active Equity Fund 113 9.80 105 9.74 107 8.52 92 10.51 70 7.82 55 6.13

36ONE BCI Equity Fund 92 13.85 67 13.84 62 13.55 49 14.47 3 13.76 4 10.69

3B BCI Blended Equity Fund 87 15.01 83 12.63 79 12.60 66 13.39

3B BCI Equity Fund 88 14.53 97 11.03 92 11.26 50 14.40 50 9.16 41 7.30

Accorn BCI Equity Fund 91 14.20 85 12.38 86 12.06 98 9.34 63 8.27 61 4.66

Aeon Active Equity Prescient Fund 14 24.42 55 14.49 24 15.53 55 14.02

AF Investments Equity Fund of Funds 48 19.90 19 16.37 38 14.78 42 14.84 19 10.94 10 9.83 14 10.87

African Alliance Equity Prescient Fund 24 21.49 46 14.95 45 14.55 86 11.30 41 9.53 52 6.47

Allan Gray Equity Fund 52 19.59 17 16.46 11 16.87 15 16.76 35 10.05 16 9.36 5 12.98

Amplify SCI Equity Fund 12 24.58 8 18.43 6 17.65 35 15.20 37 9.79 34 7.74

Anchor BCI Equity Fund 9 25.83 5 18.67 14 16.25 56 13.96 57 8.74 53 6.37

APS Ci Equity Fund 99 13.31 98 10.89 96 10.89 80 11.85 27 10.38 33 7.75

Autus Prime Equity Fund 116 9.44 109 8.72 95 10.98 93 10.14 65 8.23 46 6.83

Aylett Equity Prescient Fund 78 16.52 71 13.68 57 13.81 7 18.16 7 11.77 3 10.96

Baymont Equity FR Fund 76 16.92 76 13.28 58 13.77 74 12.26

BCI Best Blend Specialist Equity Fund 38 20.66 62 14.21 76 12.87 59 13.85 56 8.76 44 6.99

BlueAlpha BCI Equity Fund 95 13.78 75 13.48 87 12.03 89 10.61 61 8.31 38 7.50

Camissa Equity Alpha Fund 2 34.03 4 19.05 32 15.01 5 18.47 5 13.66 2 11.16 3 13.54

Camissa Islamic Equity Fund 89 14.43 103 10.48 109 7.98 63 13.48 45 9.45 17 9.36

Capita BCI Equity Fund 97 13.64 100 10.71 91 11.32 99 8.80 88 4.29 59 5.32

Centaur BCI SA Equity Fund 71 17.77

Cogence Equity Prescient Fund of Funds 30 21.22 56 14.49

Community Growth Equity Fund 74 17.12 48 14.87 37 14.82 34 15.22 22 10.75 25 8.48 13 10.95

Coronation Equity Fund 1 36.90 3 23.07 2 20.04 14 16.87 6 12.73 5 10.52 2 13.57

Denker SCI Equity Fund 28 21.30 31 15.74 20 15.76 12 17.12 21 10.81 42 7.25 12 11.35

Differential Neural Equity Prescient Fund 72 17.73 52 14.58 47 14.41 32 15.31

Discovery Equity Fund 20 22.05 14 17.03 28 15.29 65 13.44 33 10.07 19 9.11

Dotport BCI Equity Fund 115 9.46 88 12.29 98 10.68 96 9.41 84 5.70

Dynasty Ci Wealth Accumulator Fund 101 12.60 90 12.06 54 14.13 84 11.57 29 10.23 31 7.89

Edge BCI Equity Fund 102 12.21 101 10.68 88 11.83

Element SCI Earth Equity Fund 118 8.37 93 11.72 101 9.69 79 11.90 77 6.70 51 6.57 23 7.44

Element SCI Islamic Equity Fund 125 0.96 115 7.32 110 7.63 94 9.91 47 9.20 28 8.40

Excelsia Equity 27four Fund 6 27.04 26 15.99 83 12.38 27 15.77 52 9.05

Fairtree Blended Equity Prescient Fund 66 18.03

Fairtree Select Equity Prescient Fund 96 13.66 68 13.74 18 15.95 8 17.94

Profile’s Unit Trusts & Collective Investments September 2025 205