Page 140 - Profile's Unit Trusts & Collective Investments - September 2025

P. 140

Chapter 8 Classification of CISs

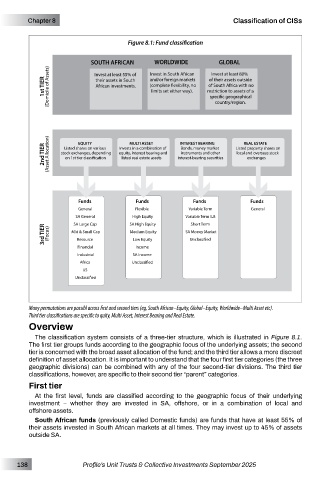

Figure 8.1: Fund classification

Many permutations are possibl across first and second tiers (eg, South African–Equity, Global–Equity, Worldwide–Multi Asset etc).

Third tier classifications are specific to quity, Multi Asset, Interest Bearing and Real Estate.

Overview

The classification system consists of a three-tier structure, which is illustrated in Figure 8.1.

The first tier groups funds according to the geographic focus of the underlying assets; the second

tier is concerned with the broad asset allocation of the fund; and the third tier allows a more discreet

definition of asset allocation. It is important to understand that the four first tier categories (the three

geographic divisions) can be combined with any of the four second-tier divisions. The third tier

classifications, however, are specific to their second tier “parent” categories.

First tier

At the first level, funds are classified according to the geographic focus of their underlying

investment – whether they are invested in SA, offshore, or in a combination of local and

offshore assets.

South African funds (previously called Domestic funds) are funds that have at least 55% of

their assets invested in South African markets at all times. They may invest up to 45% of assets

outside SA.

138 Profile’s Unit Trusts & Collective Investments September 2025