Page 315 - Profile's Unit Trusts & Collective Investments - March 2025

P. 315

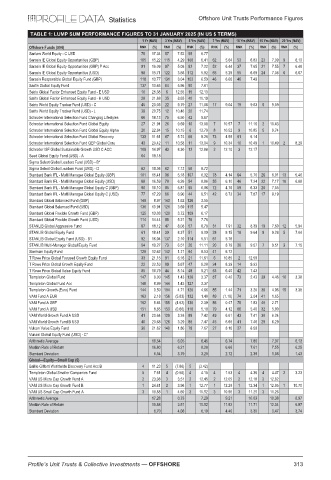

Statistics Offshore Unit Trusts Performance Figures

TABLE 1: LUMP SUM PERFORMANCE FIGURES TO 31 JANUARY 2025 (IN US $ TERMS)

1 Yr (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 15 Yrs (NAV) 20 Yrs (NAV)

Offshore Funds (594) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Sanlam World Equity-CUSD 75 17.34 57 7.52 99 6.77

Sarasin IE Global Equity Opportunities (GBP) 105 15.22 115 4.29 106 6.41 62 5.64 53 6.83 23 7.09 9 6.13

Sarasin IE Global Equity Opportunities (GBP) P Acc 91 16.09 97 5.08 92 7.22 52 6.44 37 7.65 21 7.55 7 6.48

Sarasin IE Global Equity Opportunities (USD) 98 15.71 122 3.66 112 5.92 65 5.29 55 6.69 24 7.08 6 6.67

Sarasin Responsible Global Equity Fund (GBP) 118 13.77 131 3.04 102 6.59 46 6.66 40 7.49

Sasfin Global Equity Fund 137 10.65 84 5.96 80 7.61

Satrix Global Factor Enhanced Equity Fund-EUSD 10 25.38 6 12.55 15 12.13

Satrix Global Factor Enhanced Equity Fund-HUSD 28 21.88 35 8.65 40 10.19

Satrix World Equity Tracker Fund (USD) - C 45 20.03 22 9.79 27 11.08 17 9.04 19 9.63 6 9.59

Satrix World Equity Tracker Fund (USD) - L 39 20.75 12 10.46 20 11.74

Schroder International Selection Fund Changing Lifestyles 66 18.13 75 6.50 42 9.67

Schroder International Selection Fund Global Equity 27 21.91 26 9.69 10 13.08 7 10.57 7 11.16 2 10.43

Schroder International Selection Fund Global Equity Alpha 20 22.84 15 10.15 6 13.79 8 10.52 9 10.85 5 9.74

Schroder International Selection Fund Global Recovery 133 11.61 87 5.74 66 8.26 73 4.59 61 6.14

Schroder International Selection Fund QEP Global Core 43 20.42 11 10.58 11 13.04 9 10.34 10 10.49 1 10.49 2 8.29

Schroder ISF Global Sustainable Growth USD C ACC 109 14.97 43 8.30 12 12.88 2 12.10 3 12.17

Seed Global Equity Fund (USD) - A 64 18.18

Sigma Select Global Leaders Fund (USD) - B*

Sigma Select Global Leaders Fund (USD) - D 62 18.36 62 7.12 58 8.72

Standard Bank IFL - Multi Manager Global Equity (GBP) 101 15.41 96 5.18 107 6.32 78 4.14 64 5.70 26 6.91 13 5.46

Standard Bank IFL - Multi Manager Global Equity (USD) 88 16.59 78 6.26 54 8.86 55 6.10 46 7.24 22 7.17 10 6.08

Standard Bank IFL - Multi Manager Global Equity C (GBP) 90 16.10 85 5.81 95 6.96 72 4.76 59 6.33 20 7.55

Standard Bank IFL - Multi Manager Global Equity C (USD) 77 17.29 66 6.90 44 9.51 42 6.73 34 7.87 17 8.19

Standard Global Balanced Fund (GBP) 149 8.97 143 1.62 126 3.55

Standard Global Balanced Fund (USD) 136 10.91 121 3.69 115 5.47

Standard Global Flexible Growth Fund (GBP) 125 13.03 120 3.72 109 6.17

Standard Global Flexible Growth Fund (USD) 114 14.44 95 5.21 76 7.76

STANLIB Global Aggressive Fund 67 18.12 47 8.08 57 8.78 31 7.91 32 8.39 19 7.60 12 5.94

STANLIB Global Equity Fund 61 18.41 39 8.37 51 9.09 28 8.15 18 9.64 8 9.28 5 7.04

STANLIB Global Equity Fund (USD) - B1 92 16.04 137 2.10 114 5.51 61 5.78

STANLIB Multi-Manager Global Equity Fund 54 19.27 73 6.51 26 11.11 20 8.79 20 9.57 7 9.51 3 7.15

Stenham Equity Fund 129 12.62 142 1.71 64 8.53 41 6.73

T Rowe Price Global Focused Growth Equity Fund 33 21.15 81 6.16 21 11.61 6 10.85 2 12.59

T Rowe Price Global Growth Equity Fund 22 22.53 89 5.67 47 9.28 24 8.39 14 9.93

T Rowe Price Global Value Equity Fund 85 16.79 44 8.14 48 9.21 53 6.40 42 7.43

Templeton Global Fund 147 9.00 145 1.43 128 3.37 87 0.40 73 2.43 39 4.46 16 3.38

Templeton Global Fund Acc 148 8.99 144 1.43 127 3.37

Templeton Growth (Euro) Fund 144 9.50 104 4.71 120 4.66 85 1.44 71 3.20 38 4.96 15 3.38

VAM Fund A EUR 163 2.18 156 (5.83) 132 1.40 89 (1.18) 74 2.04 41 1.65

VAM Fund A GBP 162 5.44 155 (4.62) 130 2.39 86 0.47 75 1.83 40 2.71

VAM Fund A USD 151 8.85 153 (0.66) 116 5.19 79 4.12 66 5.40 32 5.80

VAM World Growth Fund A USD 41 20.64 129 3.24 88 7.42 49 6.61 43 7.41 30 6.24

VAM World Growth Fund B USD 40 20.68 126 3.29 86 7.47 45 6.66 41 7.46 29 6.29

Vulcan Value Equity Fund 30 21.62 140 1.86 78 7.67 27 8.16 27 8.58

Vunani Global Equity Fund (USD) - C*

Arithmetic Average 16.54 6.05 8.45 6.74 7.80 7.37 6.13

Median Rate of Return 16.80 6.21 8.20 6.66 7.61 7.55 6.25

Standard Deviation 6.54 3.79 3.20 2.72 2.39 1.98 1.43

Global—Equity—Small Cap (5)

Baillie Gifford Worldwide Discovery Fund Acc B 4 11.23 5 (7.86) 5 (3.42)

Templeton Global Smaller Companies Fund 5 7.61 4 (0.56) 4 4.15 4 1.53 4 4.36 4 4.47 2 3.23

VAM US Micro Cap Growth Fund A 2 23.08 3 3.51 2 12.45 2 12.05 2 12.16 2 12.82

VAM US Micro Cap Growth Fund B 1 24.61 2 3.96 1 12.77 1 12.29 1 12.34 1 12.95 1 10.70

VAM US Small Cap Growth Fund A 3 19.88 1 4.60 3 10.52 3 10.98 3 11.25 3 11.26

Arithmetic Average 17.28 0.73 7.29 9.21 10.03 10.38 6.97

Median Rate of Return 19.88 3.51 10.52 11.52 11.71 12.04 6.97

Standard Deviation 6.70 4.66 6.19 4.46 3.30 3.47 3.74

Profile’s Unit Trusts & Collective Investments — OFFSHORE 313