Page 153 - Profile's Unit Trusts & Collective Investments - March 2025

P. 153

Classification of CISs

The second tier classifies hedge fund portfolios according to geographic exposure:

South African portfolios invest at least 55% of their assets in local markets.

Worldwide portfolios invest in both SA and foreign markets. There are no limits set for

either domestic or foreign assets.

Global portfolios invest at least 80% of their assets outside South Africa, with no

restriction on geographical concentration.

Regional portfolios give investors at least 80% exposure to assets in a specific country or

region (such as US or Europe).

The third tier of classification is based on investment strategy:

Long Short Equity Hedge Funds predominantly generate returns from positions in the

equity market regardless of the specific strategy employed.

Fixed Income Hedge Funds are portfolios that invest in instruments and derivatives that

are sensitive to movements in the interest rate market.

Multi-Strategy Hedge Funds are portfolios that do not rely on a single asset class to

generate investment opportunities but rather blend a variety of different strategies and

asset classes with no single asset class dominating over time.

Other Hedge Funds are portfolios that apply strategies that do not fit into any of the

other classification groupings.

The fourth tier of classification applies only to Long Short Hedge Fund portfolios. These

portfolios are further categorised as follows:

Long Bias Equity Hedge Funds will, over time, aim for a net equity exposure in excess of 25%.

Market Neutral Hedge Funds are expected to have very little direct exposure to the

equity market. On average, over time, net equity exposure should be less than 25% but

greater than -25%.

Other Equity Hedge Funds is for portfolios that follow a very specific strategy within the

equity market such as listed property or a sector specific strategy.

ASISA will consider adding new categories when there are five or more hedge fund portfolios in

either the Qualified Investor Hedge Fund or Retail Investor Hedge Fund categories with an

identical or substantially similar objective and investment policy.

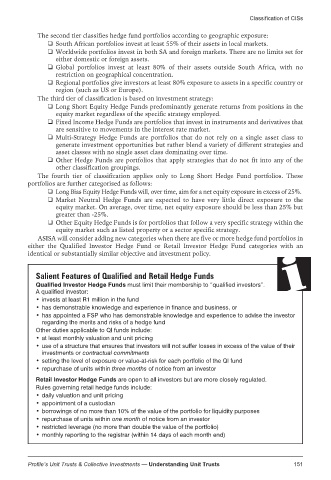

Salient Features of Qualified and Retail Hedge Funds

Qualified Investor Hedge Funds must limit their membership to “qualified investors”.

A qualified investor:

• invests at least R1 million in the fund

• has demonstrable knowledge and experience in finance and business, or

• has appointed a FSP who has demonstrable knowledge and experience to advise the investor

regarding the merits and risks of a hedge fund

Other duties applicable to QI funds include:

• at least monthly valuation and unit pricing

• use of a structure that ensures that investors will not suffer losses in excess of the value of their

investments or contractual commitments

• setting the level of exposure or value-at-risk for each portfolio of the QI fund

• repurchase of units within three months of notice from an investor

Retail Investor Hedge Funds are open to all investors but are more closely regulated.

Rules governing retail hedge funds include:

• daily valuation and unit pricing

• appointment of a custodian

• borrowings of no more than 10% of the value of the portfolio for liquidity purposes

• repurchase of units within one month of notice from an investor

• restricted leverage (no more than double the value of the portfolio)

• monthly reporting to the registrar (within 14 days of each month end)

Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts 151