Page 139 - Profile's Unit Trusts & Collective Investments - March 2025

P. 139

Classification of CISs

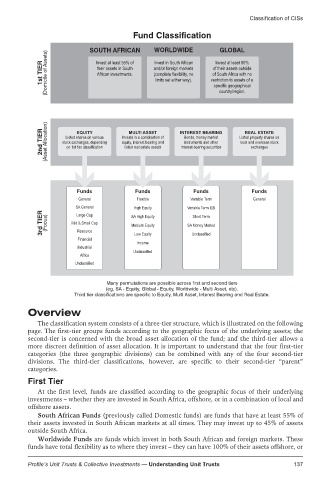

Fund Classification GLOBAL

WORLDWIDE

SOUTH AFRICAN

TIER (Domicile of Assets) Invest at least 55% of Invest in South African of South Africa with no

Invest at least 80%

and/or foreign markets

their assets in South

of their assets outside

African investments.

(complete flexibility, no

1st limits set either way). restriction to assets of a

specific geographical

country/region.

TIER (Asset Allocation) stock exchanges, depending equity, interest bearing and INTEREST BEARING Listed property shares on

EQUITY

REAL ESTATE

MULTI ASSET

Listed shares on various

Bonds, money market

Invests in a combination of

local and overseas stock

instruments and other

2nd on 1st tier classification listed real estate assets interest-bearing securities exchanges

Funds Funds Funds Funds

General Flexible Variable Term General

SA General High Equity Variable Term ILB

TIER (Focus) Mid & Small Cap SA High Equity Short Term

Large Cap

3rd Resource Medium Equity SA Money Market

Unclassified

Low Equity

Financial

Income

Industrial

Unclassified

Africa

Unclassified

Many permutations are possible across first and second tiers

(eg, SA - Equity, Global - Equity, Worldwide - Multi Asset, etc).

Third tier classifications are specific to Equity, Multi Asset, Interest Bearing and Real Estate.

Overview

The classification system consists of a three-tier structure, which is illustrated on the following

page. The first-tier groups funds according to the geographic focus of the underlying assets; the

second-tier is concerned with the broad asset allocation of the fund; and the third-tier allows a

more discreet definition of asset allocation. It is important to understand that the four first-tier

categories (the three geographic divisions) can be combined with any of the four second-tier

divisions. The third-tier classifications, however, are specific to their second-tier “parent”

categories.

First Tier

At the first level, funds are classified according to the geographic focus of their underlying

investments – whether they are invested in South Africa, offshore, or in a combination of local and

offshore assets.

South African Funds (previously called Domestic funds) are funds that have at least 55% of

their assets invested in South African markets at all times. They may invest up to 45% of assets

outside South Africa.

Worldwide Funds are funds which invest in both South African and foreign markets. These

funds have total flexibility as to where they invest – they can have 100% of their assets offshore, or

Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts 137