Page 43 - Profiles's Unit Trusts & Collective Investments - September 2024

P. 43

Basic Concepts

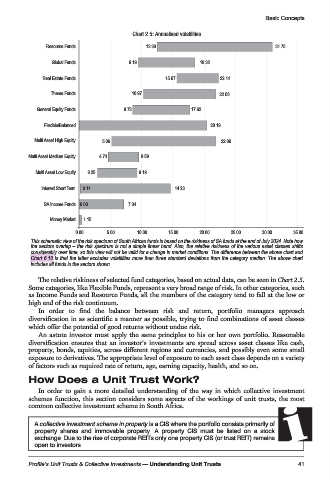

Chart 2.5: Annualised volatilities

Resource Funds 13.33 31.75

Global Funds 9.19 18.32

Real Estate Funds 15.67 22.14

Theme Funds 10.97 22.03

General Equity Funds 8.73 17.62

Flexible/Balanced 20.19

Multi Asset High Equity 5.09 22.09

Multi Asset Medium Equity 4.74 9.59

Multi Asset Low Equity 3.25 9.19

Interest Short Term 0.11 14.23

SA Income Funds 0.00 7.34

Money Market 1.15

0.00 5.00 10.00 15.00 20.00 25.00 30.00 35.00

This schematic view of the risk spectrum of South African funds is based on the riskiness of SA funds at the end of July 2024. Note how

the sectors overlap – the risk spectrum is not a simple linear band. Also, the relative riskiness of the various asset classes shifts

considerably over time, so this view will not be valid for a change in market conditions. The difference between the above chart and

Chart 6.10 is that the latter excludes volatilities more than three standard deviations from the category median. The above chart

includes all funds in the sectors shown.

The relative riskiness of selected fund categories, based on actual data, can be seen in Chart 2.5.

Some categories, like Flexible Funds, represent a very broad range of risk. In other categories, such

as Income Funds and Resource Funds, all the members of the category tend to fall at the low or

high end of the risk continuum.

In order to find the balance between risk and return, portfolio managers approach

diversification in as scientific a manner as possible, trying to find combinations of asset classes

which offer the potential of good returns without undue risk.

An astute investor must apply the same principles to his or her own portfolio. Reasonable

diversification ensures that an investor’s investments are spread across asset classes like cash,

property, bonds, equities, across different regions and currencies, and possibly even some small

exposure to derivatives. The appropriate level of exposure to each asset class depends on a variety

of factors such as required rate of return, age, earning capacity, health, and so on.

How Does a Unit Trust Work?

In order to gain a more detailed understanding of the way in which collective investment

schemes function, this section considers some aspects of the workings of unit trusts, the most

common collective investment scheme in South Africa.

A collective investment scheme in property is a CIS where the portfolio consists primarily of

property shares and immovable property. A property CIS must be listed on a stock

exchange. Due to the rise of corporate REITs only one property CIS (or trust REIT) remains

open to investors.

Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts 41