Page 231 - Profiles's Unit Trusts & Collective Investments - September 2024

P. 231

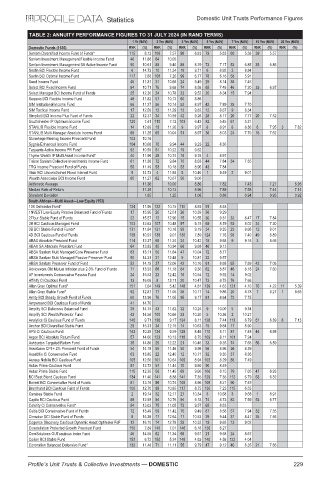

Statistics Domestic Unit Trusts Performance Figures

TABLE 2: ANNUITY PERFORMANCE FIGURES TO 31 JULY 2024 (IN RAND TERMS)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1536) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Sanlam Diversified Income Fund of Funds* 115 8.13 106 7.57 98 6.83 79 5.83 60 5.58 39 5.57

Sanlam Investment Management Flexible Income Fund 46 11.86 64 10.05

Sanlam Investment Management SA Active Income Fund 90 10.61 89 9.40 88 8.29 73 7.17 53 6.85 35 6.86

Sasfin BCI Flexible Income Fund 6 14.73 10 11.34 18 9.71 6 8.92 3 8.84

Sasfin BCI Optimal Income Fund 117 7.63 108 7.20 99 6.77 78 6.18 58 5.91

Seed Income Fund 45 11.87 31 10.66 24 9.49 29 8.14 38 7.45

Select BCI Fixed Income Fund 84 10.71 76 9.68 74 8.58 65 7.48 46 7.20 33 6.97

Select Manager BCI Income Fund of Funds 25 12.30 24 10.78 23 9.52 20 8.34 15 7.94

Sequoia BCI Flexible Income Fund 48 11.82 57 10.13 60 8.86

SIM Institutional Income Fund 66 11.27 56 10.14 52 8.97 42 7.89 25 7.70

SIM Tactical Income Fund 17 12.59 12 11.29 13 9.82 12 8.67 9 8.34

Simplisiti BCI Income Plus Fund of Funds 22 12.37 34 10.59 42 9.26 28 8.17 20 7.77 20 7.52

Southchester IP Optimum Income Fund 120 7.41 110 7.12 103 6.43 82 5.45 61 5.31

STANLIB Flexible Income Fund 14 12.89 13 11.20 9 9.97 8 8.91 8 8.36 6 7.95 3 7.82

STANLIB Multi-Manager Absolute Income Fund 68 11.25 65 10.04 51 8.97 36 8.03 24 7.70 16 7.62

Stonehage Fleming Income Prescient Fund 103 10.16

Sygnia Enhanced Income Fund 104 10.08 70 9.94 44 9.23 22 8.30

Taquanta Active Income FR Fund* 92 10.59 51 10.22 19 9.62

Thyme Wealth IP Multi Asset Income Fund* 40 11.96 28 10.74 16 9.78 4 8.97

Trésor Sanlam Collective Investments Income Fund 61 11.38 72 9.84 70 8.63 44 7.84 34 7.55

TRG Income Prescient Fund of Funds 59 11.49 53 10.18 53 8.96 43 7.84

Visio BCI Unconstrained Fixed Interest Fund 5 14.73 4 11.93 5 10.40 1 9.49 2 9.01

Wealth Associates BCI Income Fund 65 11.27 62 10.07 50 9.00

Arithmetic Average 11.38 10.00 8.86 7.82 7.43 7.21 6.95

Median Rate of Return 11.35 10.13 8.96 7.89 7.58 7.44 7.14

Standard Deviation 1.85 1.25 1.06 0.88 0.94 0.95 0.92

South African—Multi Asset—Low Equity (153)

10X Defensive Fund* 124 11.95 122 10.15 110 8.93 91 8.48

1NVEST Low Equity Passive Balanced Fund of Funds 17 15.95 20 12.51 26 10.39 38 9.29

27four Stable Fund of Funds 22 15.57 12 12.90 15 10.55 36 9.31 32 8.47 17 7.84

3B BCI Cautious Managed Fund 103 12.63 107 10.48 97 9.15 69 8.79 53 8.02 34 7.30

3B BCI Stable Fund of Funds* 131 11.64 121 10.16 93 9.19 34 9.35 23 8.68 12 8.01

4D BCI Cautious Fund of Funds 138 10.97 138 9.01 136 7.89 124 7.76 93 7.40 49 6.89

ABAX Absolute Prescient Fund 114 12.37 65 11.24 24 10.42 18 9.68 9 9.16 3 8.66

ABAX SA Absolute Prescient Fund 64 13.83 85 10.94 66 9.68 46 9.13

ABSA Sanlam Multi Managed Core Preserver Fund 83 13.11 50 11.64 47 10.04 72 8.77

ABSA Sanlam Multi Managed Passive Preserver Fund 50 14.31 21 12.48 9 10.81 22 9.57

ABSA Sanlam Preserver Fund of Fund 52 14.19 37 12.06 42 10.10 61 8.88 65 7.89 42 7.06

Adviceworx Old Mutual Inflation plus 2-3% Fund of Funds 71 13.53 68 11.18 84 9.30 62 8.87 46 8.18 24 7.60

AF Investments Conservative Passive Fund 24 15.53 23 12.42 16 10.54 12 9.92 14 9.02

Affinity Ci Cautious Fund 13 16.09 8 13.11 20 10.47 73 8.75 76 7.66

Allan Gray Optimal Fund* 151 7.04 149 5.42 148 4.81 139 4.63 121 4.10 70 4.22 11 5.39

Allan Gray Stable Fund* 92 12.87 77 11.05 36 10.17 14 9.86 20 8.78 7 8.27 1 8.65

Amity BCI Steady Growth Fund of Funds 60 13.99 76 11.05 95 9.17 81 8.64 72 7.75

Ampersand BCI Cautious Fund of Funds 41 14.70

Amplify SCI Defensive Balanced Fund 39 14.74 43 11.82 32 10.24 9 10.00 5 9.34

Amplify SCI Wealth Protector Fund 43 14.56 100 10.66 33 10.20 5 10.36 2 10.27

Analytics Ci Cautious Fund of Funds 146 9.71 136 9.17 134 8.11 128 7.44 113 6.79 61 6.39 8 7.13

Anchor BCI Diversified Stable Fund 29 15.31 34 12.15 14 10.63 15 9.84 17 8.90

APS Ci Cautious Fund 143 10.29 134 9.59 129 8.48 110 8.11 87 7.48 44 6.98

Argon BCI Absolute Return Fund 57 14.00 123 10.13 118 8.75 109 8.11 101 7.24

Ashburton Targeted Return Fund 35 14.86 29 12.22 21 10.46 33 9.35 74 7.68 56 6.59

Assetbase CPI + 2% Prescient Fund of Funds 54 14.18 55 11.46 50 9.96 56 8.96 36 8.39

AssetMix Ci Conservative Fund 63 13.85 22 12.45 12 10.71 32 9.35 37 8.36

Aureus Nobilis BCI Cautious Fund 105 12.56 101 10.64 109 8.94 102 8.29 86 7.49

Autus Prime Cautious Fund 97 12.72 57 11.44 70 9.60 90 8.49

Autus Prime Stable Fund 115 12.35 56 11.45 69 9.60 106 8.15 79 7.65 47 6.93

BCI Best Blend Cautious Fund 134 11.40 141 8.88 141 7.35 129 7.35 112 6.79 63 6.32

Bovest BCI Conservative Fund of Funds 81 13.16 95 10.74 108 8.96 105 8.21 90 7.45

Brenthurst BCI Cautious Fund of Funds 100 12.70 89 10.85 117 8.75 130 7.23 115 6.55

Camissa Stable Fund 2 19.14 32 12.17 27 10.34 3 10.68 3 9.68 1 8.91

Capita BCI Cautious Fund 88 12.93 94 10.76 94 9.18 74 8.73 82 7.59 53 6.77

Celerity Ci Conservative Fund* 84 13.03 75 11.05 73 9.57 65 8.83

Celtis BCI Conservative Fund of Funds 72 13.49 59 11.42 75 9.49 87 8.58 57 7.94 32 7.35

Cinnabar SCI Stable Fund of Funds 8 16.38 17 12.64 17 10.53 29 9.44 31 8.47 25 7.56

Cogence Discovery Cautious Dynamic Asset Optimiser FoF 12 16.10 14 12.78 29 10.32 19 9.65 13 9.02

Constellation Protected Growth Prescient Fund 150 7.89 146 7.01 146 6.16 136 6.27

CoreSolutions OUTcautious Index Fund 45 14.55 62 11.34 68 9.61 21 9.58 24 8.67

Corion BCI Stable Fund 152 6.72 150 5.24 149 4.63 140 4.58 122 4.04

Coronation Balanced Defensive Fund* 132 11.48 71 11.11 55 9.79 47 9.12 40 8.35 21 7.66

Profile’s Unit Trusts & Collective Investments — DOMESTIC 229